The supply coverage in the top eight cities has reached around 330 million square feet, and is projected to cross 470 million square feet by 2025.

The investments in logistics and organised warehousing witnessed a robust growth in 2022 on the back of India’s rising GDP and consumerism, and the expected development of multimodal logistics parks will further create more warehousing zones.

Over the past decade, India’s warehousing sector has undergone significant transformation, evolving from unorganised godown structures to becoming a prominent high-grade storage and logistics facilities.

The logistics industry in India is receiving considerable support from central policy actions like the National Logistics Policy, along with initiatives like the Gati Shakti, Bharatamala, and Sagarmala programmes, which are developing widespread transport infrastructure.

These efforts aim to promote integrated logistics and multimodal connectivity, creating a positive step towards the rapid growth of the logistics industry in India.

The development of greenfield expressways is enabling access to large land banks located along its stretches.

These land parcels, under NHAI, are seen to support the development of infrastructure for multi-modal logistic hubs.

With this, the warehouse facilities are able to setup outside of city centres, in order to reduce pollution and traffic congestion in major cities, while improving the efficiency of the supply chain and urban logistics.

Furthermore, to facilitate the growth of modern warehouses equipped with advanced technology, automation infrastructure, the government is inviting private players to invest in public-private partnership (PPP) models.

In a recent development, IndoSpace, estate branch of Everstone, invested Rs 1,000 crore to expand its warehouse premises in the National Capital Region (NCR).

The company plans to explore greenfield assets in NCR for FY24 due to expected growth in warehousing demand — particularly for third-party logistics (3PL) and e-commerce, driven by the expressway projects underway — Kundli-Manesar-Palwal Expressway and Delhi-Mumbai Expressway.

Rajesh Jaggi, vice chairman, real estate, Everstone Group, stated, “Going forward, we aim to keep up the momentum and we are sure that these new parks will play a vital role in propelling the growth of various sectors including Pharma, 3PL, e-commerce, distribution, and retail,”

Warehouse Development In India

Due to improved domestic capabilities in recent years, India has become an active player in the global manufacturing supply chain.

The warehouse acts as a fundamental part and key enabler in the global supply chain and has been on a high growth trajectory.

These logistic zones aim to cut the logistics cost for India — which is 14 per cent to 16 per cent of gross domestic product (GDP), compared to 8 per cent to 10 per cent of GDP in China and 12 per cent to 13 per cent in the US, states a Mint report.

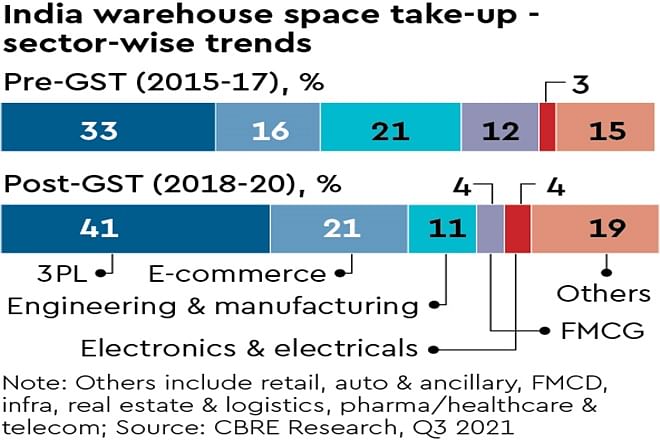

As per a Financial Express report, the first major stimulus came through the introduction of the GST regime in 2017, which saw the sector growing from 35 million square feet during 2015-17 to 77 million square feet over 2018-20.

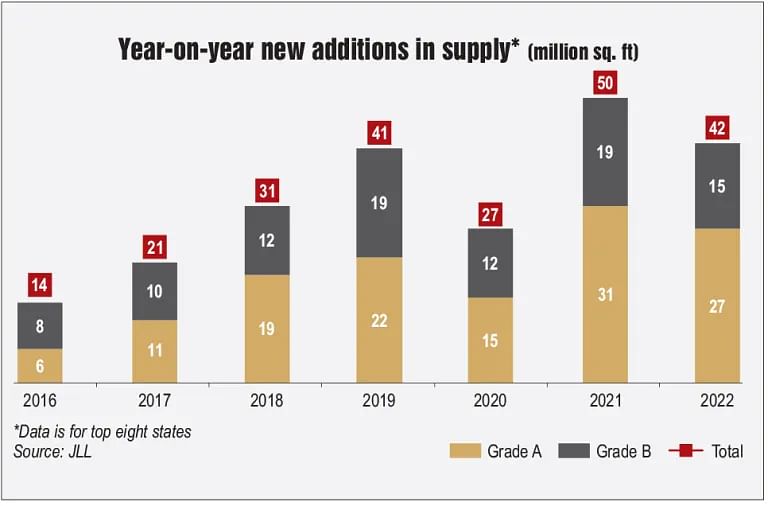

According to JLL analysis, the supply coverage in the top eight cities has reached around 330 million square feet, and is projected to cross 470 million square feet by 2025.

In the last decade, the warehousing sector has transformed into a facility with added value in terms of inventory management, packaging, product extraction, and more.

The focus on infrastructure for Grade-A warehousing supply/stock has increased, driven by rising demand for modern and larger infrastructure, over the Grade-B and Grade-C spaces which are not sufficient to meet these emerging needs.

The top eight cities in India hit an all-time high demand with a net absorption of 41 million square feet in 2022, indicating the V-shaped recovery post Covid-19.

The trend is visible with the rising tenant preference for Grade A warehouses — with 68 per cent of the net absorption attributed to it.

Additionally, a Knight Frank report revealed that the investments in logistics and organised warehousing witnessed a robust growth in 2022 on the back of India’s rising GDP and consumerism, and the expected development of multimodal logistics parks will further create more warehousing zones.

Shishir Baijal, chairman and managing director of Knight Frank India, said, “With warehouse leasing in India surpassing the pre-pandemic level, the sector is poised to take a quantum leap to match its more mature peers around the world.”

Following a report by Savills India, among the major cities in India, Delhi NCR led the pack with the highest absorption in 2022 at 16 per cent followed by Mumbai at 14 per cent, of the total area absorption in the industrial and warehousing space.

The 3PL and e-commerce sectors played a significant role in the growth of warehousing demand, responsible for 52 per cent of total absorption.

The Driving Industries

The growth of 3PL companies and the rapid expansion of retail and e-commerce have emerged as the primary drivers of the Indian warehousing market.

In 2022, the top three sectors that acquired the most space were 3PL (43 per cent), auto and engineering (20 per cent), and fast-moving consumer goods (FMCG) and retail (16 per cent), accounting for almost 80 per cent of the annual take-up.

The share of 3PL companies in the warehousing space increased significantly from 31 per cent in 2021 to 43 per cent in 2022.

The logistics infrastructure has evolved further on the back of the growth of the retail and e-commerce sectors.

During the pandemic, e-commerce played a crucial role in supporting metro cities.

According to the Mint report, the e-commerce sector’s share in transactions increased from 18 per cent in FY17 to 31 per cent in FY21.

The Indian e-commerce market is poised for its next phase of growth, with industry leaders and international agencies also entering the market.