- From importing Russian crude to record exports, India’s oil strategy signals it is finally mastering the global oil game.

How many readers would know that India became the third largest exporter of refined petroleum products in 2023? Or, that India was the third largest supplier of petroleum products to Europe last year?

These nuggets, and others detailed in our annual survey of the Indian energy sector, are powerful indicators of how India, as the third largest consumer of crude oil in the world, is finally learning to play the global oil game.

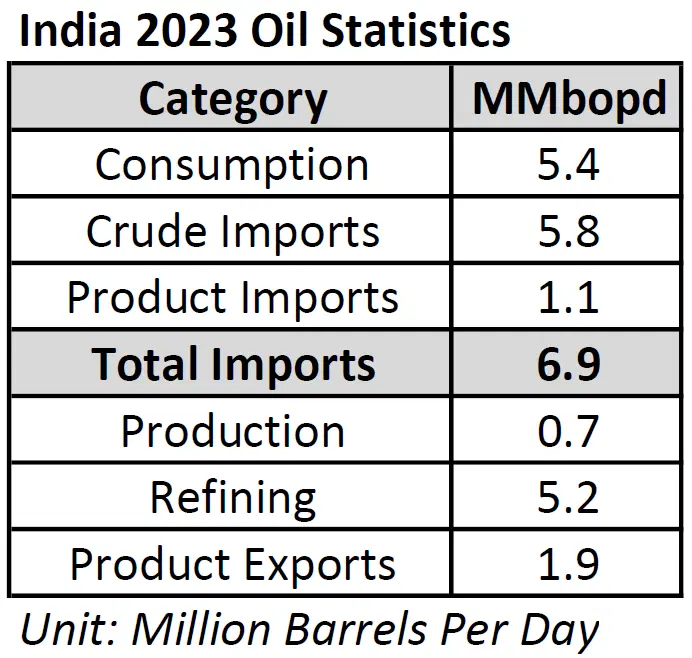

Some basic statistics first:

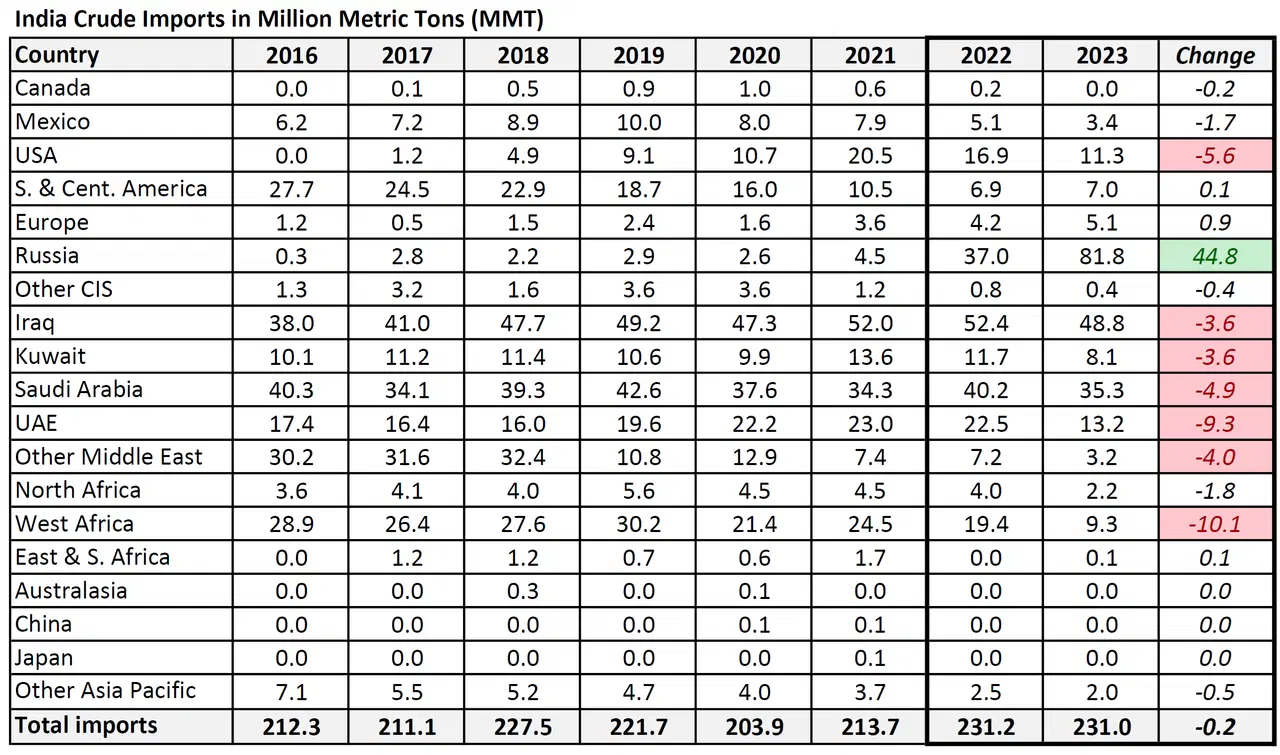

Second, an import table for India from 2016 to 2023, showing country-wise volumes of annual crude oil purchases in million metric tonnes (MMT):

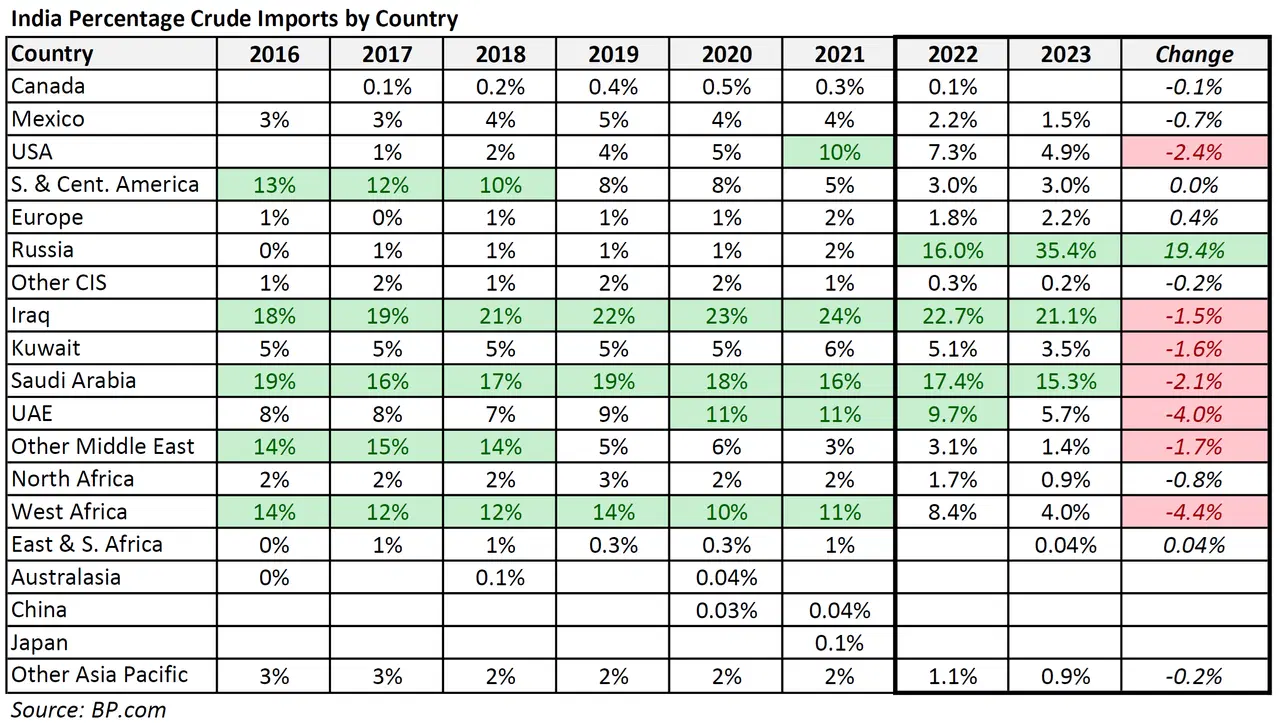

Traditionally, India used to source around two-thirds of its crude oil from the Middle East, and the balance roughly equally from West Africa and Hispanic America.

But in the past decade, this pattern has shifted twice.

First, between 2015 and 2021, the volumes procured from Spanish-speaking parts of the New World declined from around a sixth of India’s total crude oil imports to under a tenth.

In its stead, during this period, the United States (US) under President Donald Trump rapidly scaled up exports from next to nothing to 10 per cent. India also stopped buying crude oil from Iran during this period.

Second, once the Russo-Ukrainian conflict broke out in early 2022, and disrupted oil trade severely, after Europe foreswore a sizeable portion of their imports from Russia and started sourcing their requirements from elsewhere, India began purchasing very large quantities of crude from Russia.

It was a smart move because it allowed India to avoid getting trapped in a dual melee of sudden scarcity and rising prices.

This new sourcing pattern by India, aside from reducing Western sanctions on Russia to a proverbial dead letter, also meant that we got to offtake crude at a discount.

That is why we were able to retain some effective control on prices while engineering an exit from the Covid-19 pandemic, a recovery, and a return to our growth path, even as most of Europe was reeling from debilitating levels of inflation.

In the process, Indian crude oil purchases from the Hispanic Americas and Africa fell to under 5 per cent each, while imports from Russia zoomed to a whopping 35 per cent. Major exporters to India like Saudi Arabia and the Emirates, too, were forced to take a slight hit.

For the first time in a long time, Indian crude imports from the Middle East fell to under half of our total in 2023.

For Russia, the Indian government’s diplomatic nimbleness was a godsend, since it, along with similar increases in exports to China, aided them immensely in overcoming to a good extent, the grave financial crisis they would otherwise have faced when their energy exports to Europe declined drastically from 2022 onwards.

No doubt, Russian oil exports did decline by 38 per cent between 2021 and 2022, but amazingly, their crude exports have almost completely recovered to pre-conflict levels courtesy increased off-takes by China, and novel purchases by India.

The numbers are truly staggering: in 2023, 78 per cent of Russian crude oil exports went to China (44 per cent) and India (34 per cent).

And then, there is the intriguing case of rising exports of refined petroleum products from India. The latest data shows that apart from importing crude oil for domestic use, India has made additional imports and also increased the export of refined petroleum products in the past two years.

In the preceding years, exports of these products from India used to hover annually around the 60 MMT mark, but in 2023, a record 93 MMT of petroleum products were exported. That is almost two million barrels a day, and the increase is over 50 per cent.

Now, it would be most indelicate to say where this crude oil came from, and where the products went to, but we might not be wrong in saying that some people in Moscow, Jamnagar, Vadinar, or Rotterdam, could well have celebrated 2023 as a banner year. So much for sanctions.

This is the new India we are slowly transforming into, efficiently managing crises which would otherwise have broken our backs, tactfully, skilfully, kneading global dynamics to protect our national interests, and leveraging the sheer size of our market to achieve our aims. And how we play the oil game is an excellent metaphor for that change.