Snapshot

- A robust budget allocation and announcement of incentives reveal the government’s intention to put the development of EV infrastructure in the fast lane.

Last week, the Union cabinet approved the proposal for implementation of the FAME II scheme. FAME is the acronym for ‘Faster Adoption and Manufacturing of Electric Vehicles in India Phase II’ and sums up the intention behind the adoption of the policy.

The budget outlay for FAME-II is Rs 10,000 crore against the expected outlay of Rs 5,500 crore. This is more than 10 times the Rs 895 crore outlay of FAME Phase I, and such a massive outlay comes as a pleasant surprise. Upfront incentives on the purchase of electric vehicles (EV) were announced that would help 10 lakh e-two wheelers, 5 lakh e-three-wheelers, 55,000 e-four-wheelers and 7,000 e-buses.

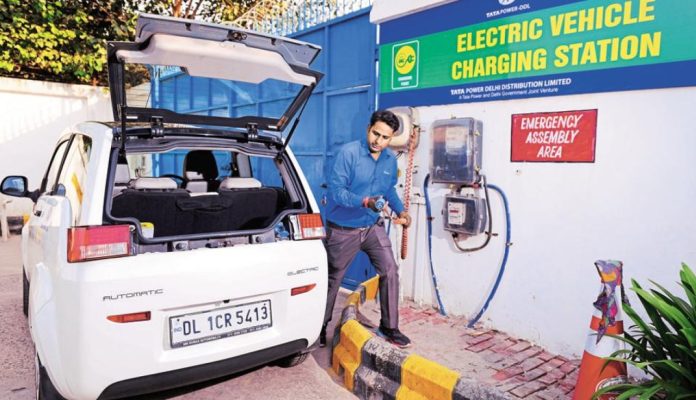

Apart from demand-incentives, the outlay supports establishment of charging infrastructure, with at least one charging station in a grid of 3 km-by-3 km, and at an interval of about 25 km each on highways. A budget has also been allocated for an autonomous body, entrusted with setting up state-of-the-art test facilities in the country.

This comprehensive package provides three crucial insights. Firstly, it indicates that there is no ambiguity on the government’s own stand and intention in the EV domain. Secondly, this would lead to an increase in demand for EVs and finally, unlike before, the entire eco-system is being considered holistically and tackled systematically.

Industry cheered the move by the government, saying that it would “put adoption of EVs in the fast lane” and “create an environment for all players to commit to the journey of sustainability”.

The Economic Times has reported on some more aspects of the scheme, which indicate a well-thought through approach geared towards increasing both manufacturing and the adoption of electric vehicles. The government has placed stiff localisation riders for the automotive industry to avail incentives upfront under the FAME II initiative. In manufacturing, the localisation-rider will spur domestic industrial production through ripple effects, thereby creating employment.

The report also mentions that e-buses have to be leased on an opex (operating expenditure) basis to state transport undertakings. This would mean that the capital expenditure of procurement and maintenance cost will remain with the manufacturers, while the state transport units will only pay per kilometre of use.

With reduced dependence on imports, it is being ensured that the savings from oil imports (one of the original arguments for moving to EVs) are not substituted for the EV-industry paraphernalia. This allows India to hold its own in an increasingly-protectionist environment. Importantly, we stand on firm ground vis a vis China, which seeks new territory in the wake of its own domestic slowdown.

Chinese e-buses have been facing rough times in the US. In December last year, 15 electric buses manufactured by BYD of China had to be returned in Albuquerque, United States, with the mayor also announcing legal action against the company. There were issues with the promised range, and malfunctioning doors and brakes along with issues of over-heating. Reportedly, Los Angeles had also faced similar problems with the Chinese bus company. Many transit agencies are now ordering from Proterra and New Flyer, America’s in-house manufacturers.

The localisation insistence on the part of Indian policy-makers, needs to be seen as an opportunity in a sunrise area and not a threat. Indian industry is already on its way to achieving success in various areas within the ecosystem – companies like M&M, Ather, Tata Motors, to name just a few.

Ather Energy, for instance, apart from manufacturing two-wheelers, has several innovative solutions in charging infrastructure. Ather had also collaborated with Venkat Viswanathan and a team from the Carnegie Mellon university, to develop a model to map out charging points and battery-swapping stations for EVs. These stations were prepared factoring in traffic, most-used routes, peak times, vehicle charging patterns and so on.

Using “infrastructure networks for charging EVs through physics-based transient systems” (INCEPTS), as their computing solution, they were able to simulate vehicles and provide a map of the best locations to place chargers. The idea was to ensure optimal utilisation of chargers by lowering infrastructure costs and solving range anxiety of customers at the same time. Though conceptualised for Delhi, INCEPTS is a city-agnostic platform.

Charging infrastructure, as we know, has been the Achilles Heel of the EV story so far. And this is true not just in India but across countries. A conference to be held in Germany a few months down the line, presents the following discussion premise to potential attendees. “Electric Vehicles (EVs) present an opportunity to transform the transportation sector with many potential benefits….Although electricity is ubiquitous, a robust charging infrastructure is still lacking to make electro mobility a complete reality. To help industry professionals transition, BIS Group introduces the EV Charging Infrastructure Forum…to discuss the challenges and opportunities of developing the charging infrastructure network”, it reads.

Everyone including India is currently looking for solutions.

The `Adoption’ Part, Going Forward

For e-two-wheelers, subsidies are boosting demand. The risk and `fear-of-the-unknown’ is the least with the two-wheelers. Capital and running costs are already comparatively lower, and the charging infrastructure is not posing a significant problem. This category of vehicles is the most suited to home–charging, with simple plug-in technology like any electrical appliance.

Overall car sales have been sluggish in the country, with mobility preferences shifting to shared transport. But two-wheelers are still a growth category (both new and second-hand), and are now breaking new ground, into villages. In urban areas, students are potential buyers, especially given their awareness about “saving the environment and using clean energy”.

When Nudge Comes To Push

It then makes sense to take up e-two-wheelers as a social project, and make people opt for them. After the subsidy, it is now necessary to induce demand proactively in different ways.

This can be done by using Thaler’s “nudging” principle. Nudging is a Nobel-Prize-winning theory of behavioural economics, which brings psychological principles into matters of public policy. It simply means creating the right conditions to influence the behaviour of citizens without using any form of coercion. This would be similar to the strategy used for the Ujjwala scheme.

Sharma Pareek’s paper plugged above details how nudging was used along the length of the Ujjwala scheme. It points out that the “heuristics” employed were: a) availability, which aims at showing a thing so much that people question it less. This was done by holding thousands of safety camps and using mass media such as advertisements, videos, etc. b) Nudges of interest-free loans by reaching the doorstep of the economically weak customers proactively, rather than waiting for them to negotiate their ways c) addressing aversions and fears through posters with pictorial depictions, which were to be hung at eye-level.

Similarly, nudges to suppliers included: a) awards to district-level officers and also morale-boosting through interactions with senior-level officers as well as the minister in-charge. b) Officers were allowed to interact with the press as also use social media, where they tagged the minister and top officials when showcasing their work, which got them acknowledgement, and this also helped cut red tape and achieve targets.

Such small changes may be used in the e-two-wheelers segment, which can bring about significant changes in choices and influence decision-making positively.

Both for nudging for two-wheelers as also installation of charging infrastructure with the increased FAME II allocation, towns and cities with higher pollution levels should be the obvious priority.

Lease, Please

In public transport, buses have remained a concern area. We brought to light some examples earlier of state transport corporations (STCs) being loathe to deploying e-buses. Funding shortfalls and the discomfort of transitioning to a new technology are the main impediments in the adoption of this new technology.

Now, FAME II has put in place a subsidy for buses. Besides, the issue of heavy capital expenditure (capex) has been addressed by the new clause related to leasing. The procurement and maintenance cost remains with the manufacturers, while the STCs lease the buses from the manufacturer and pay per-kilometre of use.

A study by Columbia University – “Electric Bus Analysis” – commissioned by New York City Transit came up with options that could be useful in our Indian STCs’ scenario. The purchase contract for an electric bus could be negotiated with the battery as a separate cost.

Two, bus manufacturers could ‘lease’ the batteries to cities. Battery cost, as we know, is huge in electric vehicles. The author’s suggestion is that the cost of the battery be like the ‘fuel cost’ of the bus, which when spread out, will be close to the fuel cost of the diesel bus, with electricity cost added.

This, the authors say is important, because it matches the budgeting process of the city with the cost of the bus in the capital budget, and the cost of fuel in the annual budget.

“By providing the financials to the city in that fashion, the bus manufacturer eliminates the issue of higher up-front costs for the electric bus, and financial consideration for the return on investment and the payback period. The electric bus becomes straight out less expensive to the city from a financial perspective”.

This also means that the bus manufacturer bears the risk of the uncertainty related to the life of the battery. “By leasing the battery to the city, the bus manufacturer displays partnership with the city…”

Operational expenditure can be further lowered by lower cost electricity, reduced tax and registration charges etc. and other incentives. The study calculated that the lifetime cost of an electric bus was at least 10 per cent lower compared to a diesel bus.

Some Indian STCs have had issues with leasing buses. Owning the buses and leasing batteries may be more acceptable to them. This analysis for an alternative transport fleet, for a city known to have among the best mass transportation in the world, is significant. It would help STCs and state government to have academic institutions like IISc and IITs do similar studies for their cities and find specific solutions. For the inertia in transition that comes from a mental block, training at all levels could also be planned for STCs and state transport officials at all levels.

Another interesting solution for financing to overcome the financial hurdle of transition comes from the U.S. PIRG Education Fund, an organisation that works to protect consumers and promote good government. They have suggested a ‘vehicle to grid technology’. When equipped with this technology, electric buses can use their batteries for energy storage, providing a service to the grid by selling electricity back at times of high demand. This may come much later in the scheme of things, but serves as a reason to be optimistic.

Overall, optimism, research and perseverance is the way ahead, as the world continues with new research in all aspects of this sector and shares experiences.

The Government of India has exceeded expectations in providing this sector and the industry, with the necessary impetus. Now it is time for auto manufacturers, energy companies, transport organisations, NITI Aayog, EESL et al, to come together to formulate a winning strategy.

In the case of Ujjwala, the strategy included considerable investment, and fuel retailers like IOC, BPCL and HPCL came forward to set up LPG infrastructure. This included setting up terminals, laying pipelines and building LPG bottling plants. All this would also increase employment, provide more business opportunities and further boost Make in India. Could this be another leaf to be taken from the Ujjwala scheme?

Each country has its unique conditions, demographics and compulsions that require tailor-made solutions. That said, we hope our two-wheelers and three-wheelers win this global race.