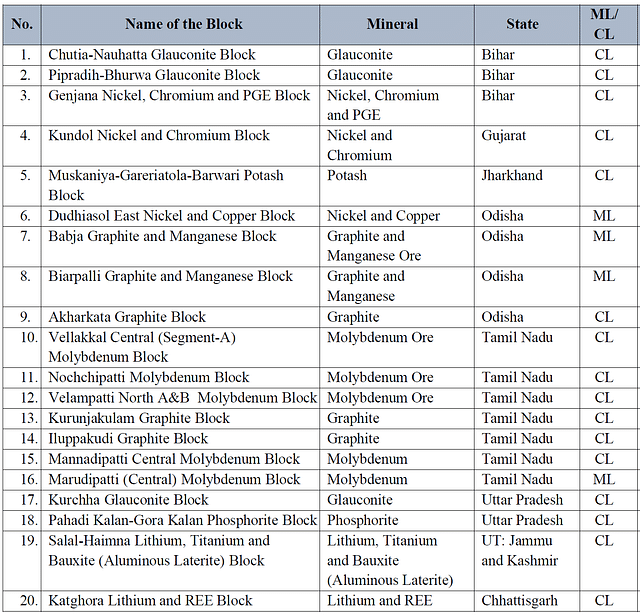

Last week, the Centre put up twenty blocks of critical minerals for auction, opening them to commercial mining by the private sector. The first such auction was launched by Union Minister of Coal and Mines, Pralhad Joshi, on 29 November and bids can be submitted until 22 January next year.

Besides Lithium, the minerals on offer are titanium, bauxite (aluminous laterite), glauconite, nickel, chromium, potash, copper, graphite, manganese ore, molybdenum ore, phosphorite, platinum group elements (PGE), and rare earth elements (REE). These minerals find applications in sectors such as renewable energy, defence, and agriculture.

These blocks are spread across seven states — seven blocks in Tamil Nadu, four in Odisha, three in Bihar, two in Uttar Pradesh, and one each in Gujarat, Jharkhand, Chhattisgarh — and one in the Union Territory of Jammu & Kashmir.

According to the Notice Inviting Tender (NIT) released by the Ministry of Mines, four mineral blocks have been earmarked for the grant of a Mining Licence (ML), while a Composite Licence (CL) will be granted for the remaining 16 blocks.

While the mining lease is for blocks with proven reserves of minerals, the composite licence (prospective-cum-mining) is for areas where preliminary exploration has been conducted by the government, but further exploration is required by mining companies.

The blocks that will be granted a mining licence include one block of Molybdenum in Tamil Nadu and four blocks in Odisha, containing deposits of nickel, copper, graphite, and manganese. For these blocks, the State Government shall grant the mining lease to the successful bidder, who can then conduct mining operations within the lease area after obtaining the requisite clearances.

In the case of the CL, the successful bidder shall conduct a geological exploration of the area under the composite licence to ascertain evidence of mineral contents.

Once the bidder establishes the existence of mineral contents, they may submit an application to the State Government for the grant of a mining lease. The concessionaire will have to obtain all the consents, approvals, permits, and no-objections for the commencement of mining operations.

The auction will be conducted online through a two-stage ascending-forward process, with eligible bidders being selected based on the highest percentage of mineral dispatch value quoted by them.

First-ever auction of lithium

In a first, the centre has put two blocks of lithium reserves, one each in J&K and Chhattisgarh, for auction for a CL.

As per the preliminary exploration stage (G3), the Salal-Haimana block in Reasi district of Jammu and Kashmir has an inferred reserve of a 5.9 million tonne (mt) of bauxite column, which contains approximately 3,400 tonnes of lithium metal content, along with nearly 71,000 tonnes of titanium metal content.

Moreover, the Katghora block located in the Korba district of Chhattisgarh is reported to have the presence of both lithium and rare earth element (REE) minerals, as indicated by the reconnaissance survey conducted by the Geological Survey of India (GSI).

The “inferred” mineral resource is part of a resource for which quantity, grade, and mineral content are estimated only with a low level of confidence based on information gathered from locations such as outcrops, trenches, pits, workings and drill holes that may be of limited or uncertain quality, and also of lower reliability from geological evidence.

The move to put these two blocks for auction of composite licence aims to leverage private expertise in enhancing the exploration level to evaluate the complete economic potential of these minerals.

Also referred to as “white gold”, lithium is a non-ferrous metal and is used in rechargeable batteries, which power not only laptops and mobile phones but also electric vehicles (EVs) — a crucial part of the world’s plan to tackle climate change.

One Step At A Time

The auction process for twenty critical mineral blocks marks the culmination of a series of policy changes implemented by the government over the past year, all aimed at attracting private investment into the mining of these crucial minerals.

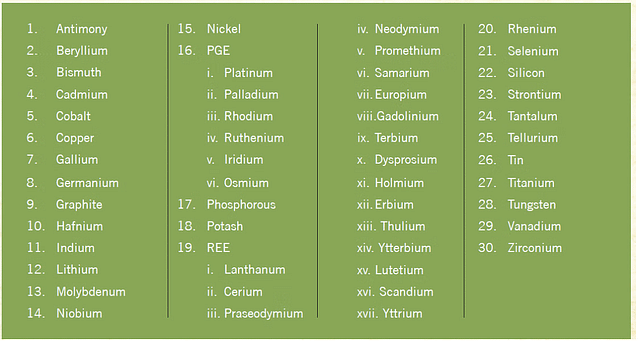

To start with, the Centre in June 2023, released a list of thirty critical minerals that it considers essential for economic development and national security of the country.

Critical minerals are those minerals which are essential for economic development and national security, the lack of which, may lead to supply chain vulnerability and disruption.

Some 30-odd critical minerals identified include the likes of titanium, tungsten, vanadium, zircon, niobium, germanium, nickel, graphite, silicon, antimony, beryllium, bismuth, among others.

The list serves as the cornerstone on which the the government is formulating policy measures to secure the country from the supply chain vulnerability of these minerals.

The critical minerals list was followed by the amendment to the Mines and Minerals (Development and Regulation) Act, 1957 (MMDR Act), in August 2023, which delisted six minerals and their ores — lithium, beryllium, titanium, niobium, tantalum and zirconium — from the list of atomic minerals.

Being under the atomic minerals list, the mining and exploration were previously reserved for government entities, and the August 2023 amendment opened the exploration and mining of these minerals to the private sector as well. As a result, the exploration and mining of these minerals is expected to increase significantly in the country.

Further, the amendment provided that mining lease and composite licence of 24 critical and strategic minerals, including lithium, niobium and REEs (not containing Uranium and Thorium), shall be auctioned by the Central Government.

Subsequently, in October 2023, the Centre amended the Second Schedule of the MMDR Act to prescribe rate of royalty in respect of three critical and strategic minerals, namely, lithium, niobium, and Rare Earth Elements (REEs).

The specification of new royalty rates effectively aligns India’s royalty rates with global benchmarks, and paves the way for attracting more private players into the commercial exploitation of these minerals.

Promise And Caveats

For starters, the good part is that once operational, they will help to cut down imports and build an Aatmanirbhar Bharat.

“The auction of these mineral blocks aligns with India’s objective of securing a critical mineral supply chain for energy transition and attaining its net-zero target by 2070,” Joshi said.

Incidentally, India has been import dependent on some of these key critical minerals like lithium, nickel, copper, cobalt and others, with the reliance on imports being 100 per cent for lithium and nickel and 93 per cent for copper.

Nevertheless, though the Centre’s initiative to auction these minerals is commendable, there lies a considerable journey ahead, with much hinging on private participation and the timeline for the actual commencement of mining from these reserves.