The government has come up with an ambitious plan of spending Rs 102 trillion to boost the infrastructure in the country over 2020-25 (FY), as highlighted through the National Infrastructure Pipeline (NIP).

However, the worsening fiscal stress of both the Centre and the States implies that funding this capital expenditure (capex) will be a huge challenge.

Also, we have to factor the devastating effect of Covid-19 pandemic on the global and domestic economy.

The Gross Domestic Product (GDP) may crash to 4 per cent this fiscal and we expect no growth pickup in the next two fiscal years, as the demand has collapsed, but it will depend on how the government responds to this crisis in terms of pump priming the economy.

The probability of a global recession and its transmission into the Indian economy remains elevated.

As against a combined government infrastructure spend growth of 28 per cent in FY19 (Revised Estimates), we are already set for a massive slowdown in 2020 (Budget Estimate) to 6 per cent, owing to the restricted fiscal space.

Our analysis suggests that in a business-as-usual scenario, this trend is unlikely to reverse at least for two fiscal years.

At this point, if we look at the National Infrastructure Pipeline, it paints a very rosy outlook for future opportunity and much change has happened since December 2019.

The National Infrastructure Pipeline provides visibility for a future pipeline – we believe 60 per cent of this capex is feasible in the best-case scenario assuming business-as-usual and in the worst-case may fall back to even less than 50 per cent in case a prolonged slowdown sets in.

Our estimate of Rs 61.44 trillion of capex under NIP does not assume any adverse impact from further worsening of the macroeconomic situation, leading to further cutback of infrastructure spending by the Centre or the States. At the same time, we also do not assume any major policy change or infrastructure push by the government by foregoing the fiscal deficit targets, although now, we do expect a US type Quantitative Easing (QE) and comprehensive economic package may be announced very soon together with some action by the RBI.

We take into account the current run-rate of spending in these segments of NIP and accordingly, build the base for future spending. Admittedly, the list of projects where the government is planning this spend is not available publicly and that hampers our estimate.

The biggest discrepancy between our estimates and NIP estimates relates to the capex in power and urban development segments, where we are lower by 60 per cent and 72 per cent, respectively.

Funding for NIP, however, would be a key threat to our estimate of 60 per cent feasibility of these targets.

Table 1: In our best-case scenario, we believe 60% of NIP targets are achievable

Funding Assumption By Government For NIP Is Aggressive

As per the Ministry of Finance presentation, the assumed shares of Centre/State/Private sector in the NIP target of Rs 102 trillion stand at 39 per cent/ 39 per cent/ 22 per cent. We believe this is a very aggressive assumption across all spenders.

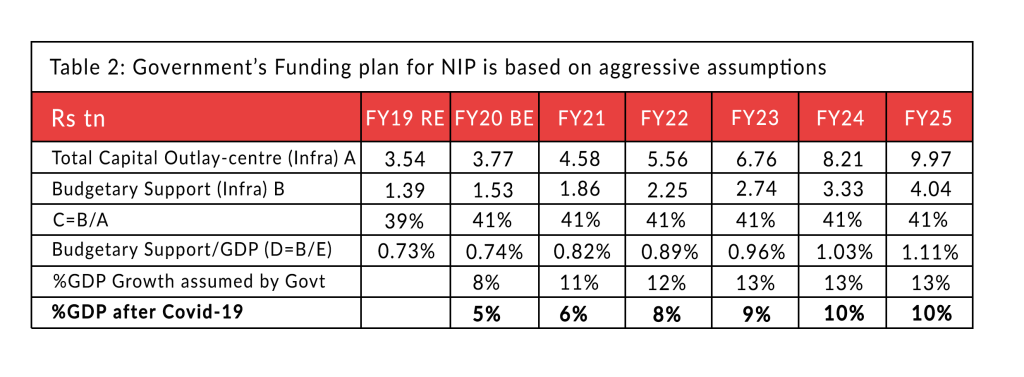

The government has assumed a 22 per cent CAGR in capital outlay by the Centre over FY20-25 and a similar growth in both budgetary support for infrastructure spend as well as Internal and External Budgetary Resources (IEBR) funding. Though this compares favourably with the 24 per cent Compounded Annual Growth Rate (CAGR) in spend by the Centre over FY13-20BE (of which 27 per cent IEBR and 22 per cent budgetary support), it seems very aggressive when looked at against the near-term growth over FY17-20BE of just 13 per cent CAGR (of which 16 per cent IEBR and 10 per cent budgetary support).

Further, the worsening macroeconomic outlook does not justify the aggressive assumption of 12.2 per cent nominal GDP CAGR over FY20-25. We forecast that even in the best-case scenario, nominal GDP may grow by 9.6-10 per cent.

In reality, we believe that the demand for Centre/State outlay will be even higher, as in the Ministry of Finance’s assumption, there is a huge reliance on private sector in the roads and power sectors, both of which may disappoint significantly.

As such, the reliance on innovative methods of external funding is key. While some of these models are now being explored, the pick-up has been gradual and is unlikely to compensate for the slowdown in the Centre/State budgetary support.

Innovative funding models needed to mitigate government dependency on infra capex still in a early stage

· Innovative models are sought to fund future capex on infra such as InvITs, TOT and SPV level fund raise; however, recent trends suggest that this would still form a small portion of the overall requirement.

· An analysis of the funding patterns of public capex in key categories suggests that the dependency on multi-lateral agencies, bond issuances etc. is rising. For example:

· Most of the metro projects are being funded largely by funds/loans from multi-lateral agencies such as JICA and World Bank.

· The NHAI has explored raising funds through the TOT model and bond issuances rather than relying on government funding alone, but has succeeded only partially so far

· Municipalities are increasingly trying to tap money from the bond market by municipal bonds (Munis) issuances but have had a patchy track record. For e.g., Indore & Pune Municipal Corporation.

We believe that infrastructure will be key for India’s growth revival and kick starting the economy. The severe blow to the global economy as well as domestic economy due to Covid-19 will present a clear danger to the NIP goals. If there is any time for innovative structural reforms it is now, or else, we can forget a V-shaped recovery in the horizon.

Unless we find innovative financing models for the Infra projects stated in the NIP, the road is long and lonely.