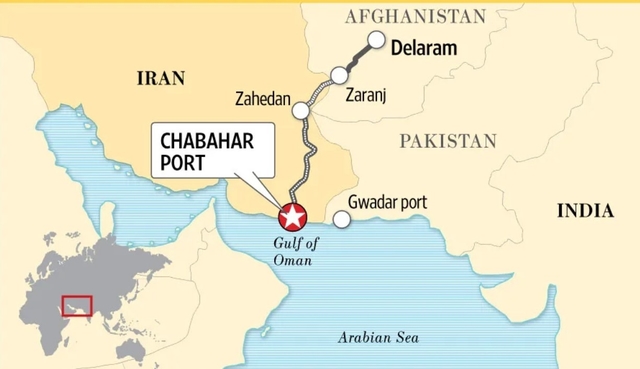

- Chabahar Port holds strategic significance for India, providing a sea-land access route to Afghanistan and Central Asia through Iran.

- It is also a crucial element of the International North-South Transport Corridor (INSTC), facilitating freight movement between India, Iran, Afghanistan, Azerbaijan, Russia, Central Asia, and Europe.

India Ports Global Ltd (IPGL), the state-owned entity responsible for developing and managing the India-funded Chabahar Port in Iran, cancelled tenders issued a year ago for the purchase of cranes and container handling equipment.

This decision adds to the challenges facing the overseas venture due to US sanctions on Iran over its nuclear program.

In September 2022, IPGL issued a tender to acquire four new post-Panamax size ship-to-shore cranes and various other equipment, including Rubber Tyred Gantry Cranes (RTGCs), all-terrain yard cranes, rough terrain yard cranes, reach stackers, empty container handlers, forklifts, terminal tractors, and trailers.

The timeline for submitting offers on these tenders was repeatedly extended as bidders hesitated to participate because of the sanctions imposed by Western countries on Iran.

On 18 September, IPGL officially canceled all the tenders without providing specific reasons. It’s unclear how IPGL plans to fulfill its commitment to procure this equipment, which is a crucial part of the agreement signed with Iran to develop Chabahar Port.

The delay in acquiring this equipment has disrupted the official launch of the ten-year contract for operating Chabahar Port.

India and Iran have resorted to operating the port through annual short-term interim contracts due to challenges in financing the purchase of essential cargo handling equipment.

The main issue lies in the fact that any equipment supplied to IPGL for Chabahar Port becomes subject to US sanctions, making it a high-risk endeavour for equipment manufacturers.

These manufacturers do not want to jeopardise their more extensive business with larger port operators by supplying to Chabahar Port.

Additionally, the banking sector poses challenges, as lenders are reluctant to open letters of credit (LC) to guarantee payments to vendors.

India Ports Global and Aria Banader Iranian Port and Marine Services Company (ABI) signed an agreement in May 2016 to equip and operate the container and multi-purpose terminals at Shahid Beheshti Chabahar Port Phase-I.

The project had a capital investment of $85.21 million and an annual revenue expenditure of $22.95 million on a 10-year lease. Revenue from cargo handling would be shared by India and Iran per an agreed formula.

The purchase tenders for equipment were also affected by the lack of funds allocated in the current fiscal year for Chabahar Port. While IPGL was seeking equipment worth approximately Rs 800 crores, the Indian government budgeted only Rs 100 crores for the development of Chabahar port, reports Economic Times.

The cancellation of the equipment purchase tenders has created confusion surrounding the project’s future. Iran reportedly agreed to extend the interim contract period by two years, provided all the equipment is supplied within 18 months. Securing the long-term contract thus depends on budgeting funds for equipment purchases and resolving other challenges.

The Economic Times report stated that the ten-year contract has not been activated yet due to obligations unmet by both sides, primarily because of the sanctions. Arbitration proceedings are being pursued in Iran to resolve contractual disputes, which is a step towards signing the long-term contract.

The exemption of Chabahar Port from US sanctions was initially granted due to the US’s interest in Afghanistan. However, with the Taliban in power, the US’s priorities have shifted, potentially impacting the Port.

Strategic significance of Chabahar Port

An Indian company, India Ports Global Limited (IPGL), through its wholly-owned subsidiary, India Ports Global Chabahar Free Zone (IPGCFZ), took over the operations of the Chabahar Port with effect on 24 December 2018.

Chabahar Port holds strategic significance for India, providing a sea-land access route to Afghanistan and Central Asia through Iran. It is also a crucial element of the International North-South Transport Corridor (INSTC), facilitating freight movement between India, Iran, Afghanistan, Azerbaijan, Russia, Central Asia, and Europe.

Russia closely monitors the project, as delays in starting long-term operations at Chabahar affect the transit agreement from Chabahar/Bandar Abbas border to the Caspian Sea/Azerbaijan.

Despite the complexities and challenges, India’s involvement in Chabahar is driven by strategic and geopolitical considerations rather than commercial profitability.

The Cabinet’s decision to develop Chabahar Port was well-informed and calculated, reflecting India’s commitment to strengthening its regional influence and connectivity.

IPGL continues to earn revenue from Chabahar Port through cargo handling, and despite losses, the project aligns with India’s broader strategic objectives in the region.

Iran also views India’s involvement as beneficial, as it helps facilitate the acquisition of cargo handling equipment that Iran struggles to obtain due to sanctions.

In conclusion, while the Chabahar Port project faces significant obstacles, it remains a crucial element of India’s strategic and geopolitical ambitions in the region, contributing to regional connectivity and trade facilitation. The challenges, including equipment procurement and sanctions, must be overcome to fully realise the port’s potential.